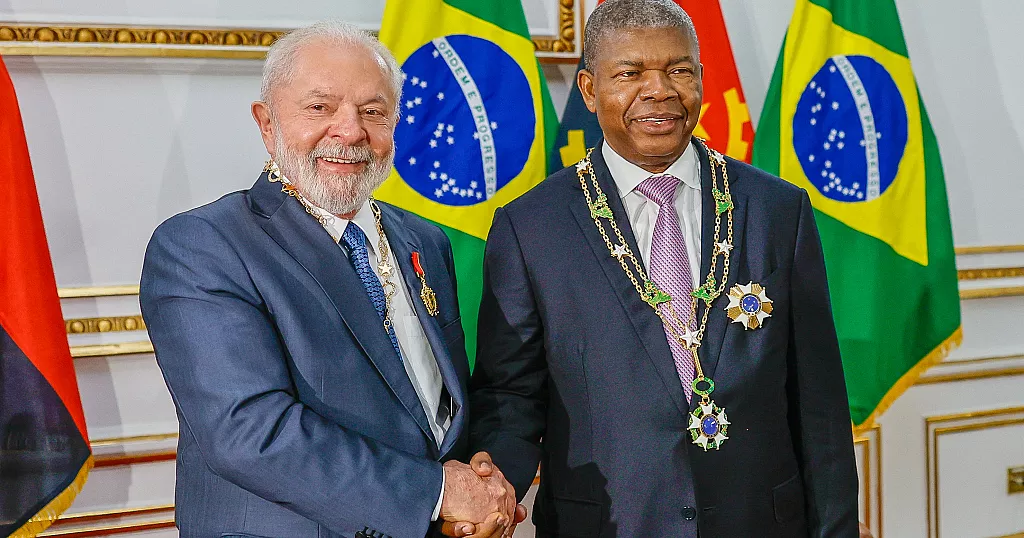

President João Lourenço urges greater BRICS role in Africa’s development

African Union President João Lourenço has called on BRICS nations to step up their involvement in Africa’s development, emphasising the vital role their financial institutions can play in bridging the continent’s infrastructure gap.

Speaking in Rio de Janeiro on Sunday, Lourenço praised the structure of the BRICS group—which brings together Brazil, Russia, India, China and South Africa—for uniting countries from diverse regions, experiences, and political systems around shared goals.

“The founding structure of this organisation includes countries from different regions of the planet, with different visions, experiences and political orientations,” he said.

“But they have come together around common aspirations, far from the logic of confrontation and the imposition of their own interests.”

The Angolan president stressed that this convergence of priorities could be instrumental in addressing global inequalities, poverty, and systemic challenges that disproportionately affect the world’s most vulnerable populations—especially across the African continent.

Highlighting Africa’s longstanding demands for a more inclusive global order, Lourenço criticised the historical marginalisation of the Global South in international decision-making forums.

“The nations of the Global South have been calling for decades for their inclusion in the discussion and decisions that are made regarding the creation of fair, balanced development factors capable of meeting their fundamental concerns, without having been able to be fully heard,” he said.

His remarks come at a critical time for BRICS, as the bloc continues to explore expanded cooperation with developing countries amid shifting global power dynamics.

Africa, rich in resources but underfunded in terms of infrastructure and industrial growth, stands as a key region for potential partnership.

Lourenço’s appeal underscores growing expectations that BRICS will go beyond rhetoric and translate political solidarity into concrete investment, particularly through institutions like the New Development Bank, often seen as a potential alternative to traditional Western-led lenders.

About The Author

dailymailafric

I am an avid African news observer, and an active member of Daily Mail Africa.

I’m Passionate about staying informed on diverse topics across the continent,

I actively contribute to publishing on political, economic and cultural developments in Africa.