President Abdelmadjid Tebboune has sought to reassure Algerians that the 2026 Finance Law will not affect household purchasing power, presenting a protective stance amid mounting economic challenges.

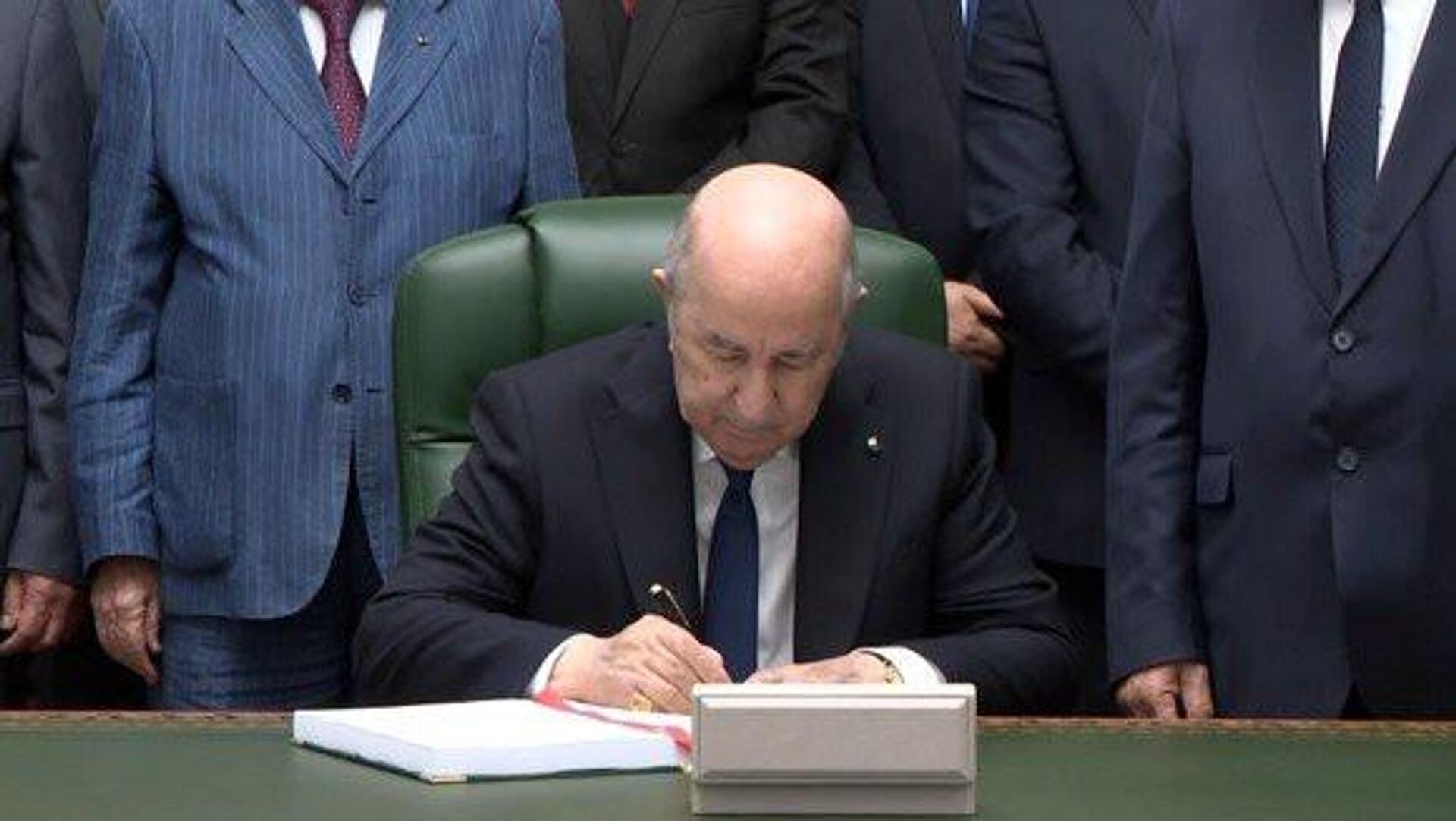

Chairing a Council of Ministers meeting, Tebboune drew a clear “red line”: no new taxes, no additional levies, and continued support for citizens’ livelihoods.

“This law will preserve the purchasing power of Algerians,” the president declared, signalling a socially sensitive approach as inflation continues to erode real incomes. According to the International Monetary Fund, household purchasing power has fallen by more than 8% in recent months, while the Algerian dinar faces gradual depreciation against foreign currencies.

Despite this reassurance, Algeria’s fiscal reality presents deep challenges.

Nearly 90% of government revenues are derived from hydrocarbons, leaving the budget highly vulnerable to global price fluctuations.

The recent decline in gas prices has already reduced external revenues, raising questions about the sustainability of ongoing subsidies and social transfers promised by the government.

President Tebboune emphasized the need for “a more efficient tax system,” yet critics note that without broadening the tax base, the measure risks being largely symbolic.

The informal economy dominates Algeria, while state-owned enterprises continue to struggle. Economic diversification and private sector growth are hindered by bureaucratic obstacles and an uncertain business climate, limiting the government’s ability to generate new revenue streams.

On another front, Tebboune resisted proposals to reclassify agricultural land for public projects, framing the move as a defence of food sovereignty.

While politically popular, the decision underscores the absence of a coherent long-term strategy to balance urban development, industrial expansion, and agricultural needs.

Analysts describe the 2026 Finance Law as a political balancing act: it aims to maintain social peace and avoid immediate public discontent while deferring the structural reforms necessary for long-term economic stability.

With 2026 expected to be a politically sensitive year, observers suggest that the president’s “red lines” may reflect electoral considerations as much as sound economic strategy.