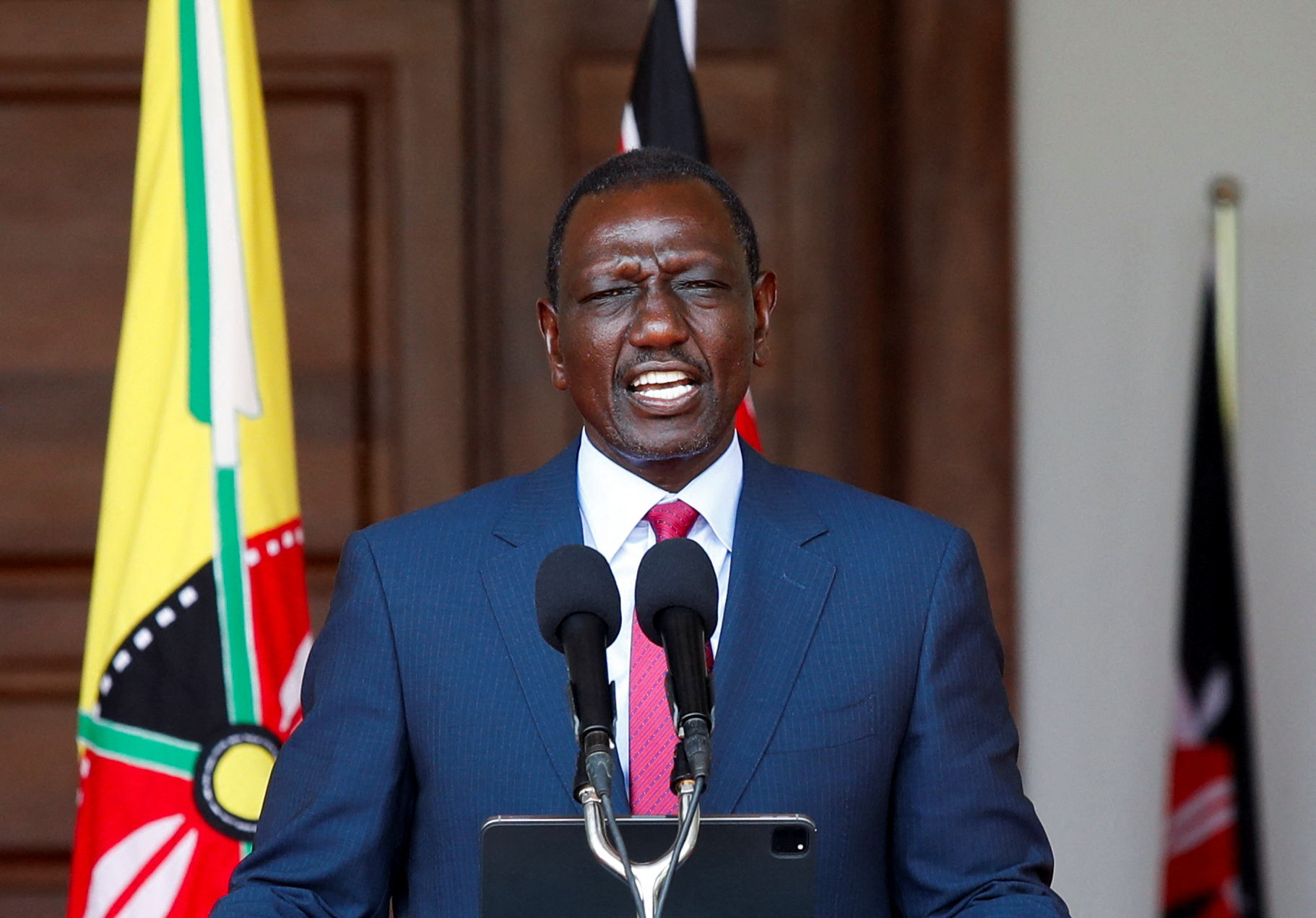

Kenya's President William Ruto speaks at a press conference where he announced spending cuts in government after protests against Kenya's proposed finance bill 2024/2025, in Nairobi, Kenya, July 5, 2024. REUTERS/Monicah Mwangi

Public debt in Kenya has surged to historic levels under President William Ruto’s administration, raising concerns over fiscal sustainability as the country heads into an election year. According to the Central Bank of Kenya (CBK), total borrowing had reached KSh 11.8 trillion as of 30 June 2025.

Kiharu Member of Parliament Ndindi Nyoro has sharply criticised the scale of borrowing, claiming the government has borrowed over KSh 3.5 trillion in just three years – more than three times what former President Mwai Kibaki borrowed in a decade.

“We have borrowed three times what Kibaki borrowed in 10 years. That’s the money Kenya has borrowed in the last three years alone, three times what Kibaki borrowed in 10 years,” Nyoro said.

The lawmaker also highlighted additional borrowing through mechanisms such as securitisation, which he said have not been fully disclosed. “I have not included other debts that Kenya has now become clever to borrow in the name of something called securitisation. I have not mentioned even that,” Nyoro added.

Nyoro warned that the current trajectory is unsustainable, pointing out that the government is borrowing approximately KSh 100 billion every month, equivalent to KSh 3.4 billion per day and KSh 137 million every hour. “We are now headed to the elections, and what governments do is focus more on re-election, forgetting that we have a country to lead after the elections,” he said.

The MP challenged the administration to demonstrate the tangible outcomes of the borrowed funds, noting that annual borrowing of KSh 1.2 trillion must be matched with visible development. “President Kibaki did a lot of development. He borrowed only 1.2 trillion for 10 years. Where is the 1.2 trillion we are borrowing every year going?” he questioned.

CBK data show that domestic borrowing has grown sharply, with over KSh 5 trillion raised through Treasury bonds in August alone, in addition to more than KSh 1 trillion through Treasury bills and other domestic lenders, including banks. Domestic debt now stands at over KSh 6.4 trillion, reflecting aggressive fiscal expansion in the lead-up to the elections.

As Kenya approaches the 2025 general elections, the debate over the nation’s mounting debt is likely to become a central issue, raising questions about long-term economic stability and accountability in public spending.